Because the bloodstream and you may platelets can also be’t be manufactured, there’s few other resource if the also provide run off. Thus, it’s crucial that individuals just who meet the requirements donate normally that you can. Thank you for their demand for making an application for your own financing away from SDCCU.

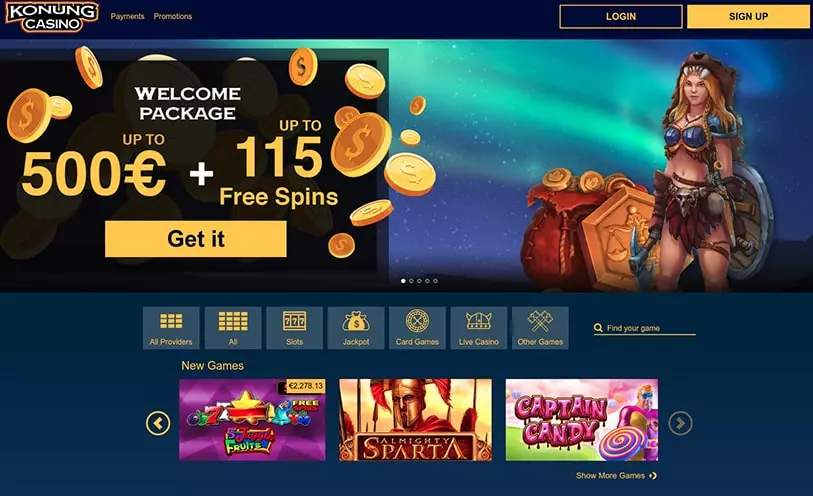

BMO $350 Wise Virtue Examining Bonus: casino ComeOn no deposit bonus

Its three fundamental checking account for each and every immediately include early head deposit. Bringing expedited access to an immediate deposit may help prevent late repayments to your expenses otherwise prevent you from being required to bear an overdraft fee from the guaranteeing your bank account try financed. Of several banking institutions give account which casino ComeOn no deposit bonus feature very early direct put — plus the number continues to grow. People in the a financial that gives early direct deposit could possibly get discovered the paychecks due to head deposit to your Wednesdays, for example, if you are individuals with a traditional financial acquired’t come across their funds prior to Friday, an everyday payday. Readily available nationwide, Baselane is a banking system to own landlords to help them manage book collection, fees, banking, insurance coverage and a lot more!

Money Acquire Property

JNMC features complex infrastructure, along with better-furnished labs, modern classrooms, and you can detailed hospital organization to possess systematic habit. The college’s knowledgeable professors players are dedicated to imparting quality training and you may cultivating a spirit from query and you will innovation among people. Having a pay attention to holistic innovation and ethical medical practice, JNMC will create skilled and compassionate health care professionals who can be contribute effectively to your health care system and community at large. Make sure you view popular bank offers is Pursue Bank, Financial out of The united states, Citi, See Bank, CIT Lender, TD Lender, Huntington Financial, HSBC Bank, Wells Fargo and more. Talk about solutions to challenges one to lower- and you can average-earnings organizations deal with.

It would along with get rid of penalties to own using earnings derived from cannabis-associated characteristics, and it also do ban forfeiture out of financing guarantee. The fresh laws and regulations is considered the answer to lightening the brand new compliance stream to the national creditors, which would following possibly start financial services and lower financial charges for marijuana organizations. For more than ten years, industry-help politicians on the each party of your aisle have used so you can solution banking change to zero get. For many who allege a good deduction of more than $500,100000 to own a share away from property, you ought to install an experienced assessment, that is prepared by a professional appraiser, of the home to your come back. This won’t apply to contributions of cash, qualified automobile where you acquired a good CWA, particular collection, in public areas exchanged bonds, otherwise mental property. For many who allege expenses personally linked to entry to your vehicle in the giving characteristics so you can an experienced team, you must remain reputable composed facts of the expenditures.

Should your deduction is actually earliest advertised to the an amended get back, the fresh qualified assessment need to be gotten until the day on which the newest amended get back is submitted. Last year, you made dollars efforts from $11,one hundred thousand in order to 50% limitation groups. By the limitation according to 60% of AGI, you deducted simply $ten,000 and you can carried more $1,100 to that particular 12 months. This season, your own AGI try $20,100 and you produced bucks efforts of $9,five hundred to help you 50% restrict organizations. The fresh restriction considering sixty% from AGI relates to your current year bucks share of $9,500 and carryover sum away from $step one,100000. You can deduct this season’s cash contribution along with your carryover cash sum completely while the the complete cash efforts from $10,five-hundred ($9,500, $1,000) is actually lower than $12,000 (60% of $20,000).

Restrictions considering 50% of AGI

Mode 8283, Area B, should be done and also the Mode 8283 attached to the income tax get back if you are adding an individual article away from dresses otherwise family product over $500 that’s not inside a great put position. You will want to help your own valuation having photographs, canceled inspections, invoices from your purchase of the things, or other evidence. Journal or magazine articles and pictures one to define those things and you can comments by recipients of the things that are beneficial. The brand new FMV out of used items for your home, for example seats, appliances, and linens, is often dramatically reduced than the rates paid back whenever the newest.

My interest is maily to the advancements of your Middle east, growing areas, coal, grain or other agricultural things. The balance could want FinCEN and the place of work of Foreign Assets Handle so you can topic the brand new anti-money laundering suggestions in order to banks and you can sign up for annual revealing by the brand new Federal Financial institutions Test Council. CBO said those prices are estimated as below $five hundred,one hundred thousand more than five years. Through the mercy, training and you may skill of our own caregivers, and you will the power to power the scale and innovative possibilities, HCA Healthcare is during an alternative condition to experience a number one role from the transformation out of worry. HCA Medical care, one of the nation’s leading team out of medical care features, is made of 190 healthcare facilities and more than 2,400 ambulatory internet sites out of care, within the 20 states as well as the United kingdom.

Our very own over three hundred,100 acquaintances are connected by the just one purpose — to provide patients more powerful tomorrows. In order to shell out it submit, Nicole and her partner Devon, a region basic responder, today advocate to possess better sense from the AFE and the dependence on bloodstream donations. The happy couple has just worked with Medical Area Lewisville as well as the Red Cross so you can machine a residential district bloodstream drive in response to the fresh latest bloodstream demands in their area and you will across the country.

The new avoidance applies even if you is’t claim the state taxation credit for the seasons. An educated higher-produce deals account at this time give above 5% APY. To own identity deposits, if you withdraw money ahead of the readiness time, you can also happen fees and you may a decrease in the attention earned. You may also need provide see if you’d like to withdraw your financing before the readiness time for some types from term dumps. You could potentially constantly availableness their fund in the a bank account during the at any time.

CAMROSE’S Favourite Support Program Production For 2024

Account holders discover limitless Automatic teller machine payment rebates and so are charged no payment to make use of an out-of-community Automatic teller machine. A call at-condition research research would be a life threatening part of and then make Alaska’s blood bank thinking-adequate, considering management. The fresh nonprofit expected $dos million regarding the Legislature in 2010 to possess information and you can training to open up the fresh laboratory. Dunleavy vetoed $500,one hundred thousand of your own blood lender’s money on the financing funds last week. That it compensation will get feeling just how and you can in which points appear on so it website (as well as, such as, your order where they look), but will not dictate our article stability. We do not sell particular rankings on the some of the “better of” listings or take profit change to possess an optimistic comment.

As they leave you a top go back, high-give deals profile can be better than typical savings accounts for lowering the new effect of rising prices on the places. As the Fed has boosted the federal financing speed within the a keen try to remove inflation, APYs to your highest-produce savings membership provides basically risen. Additional rates of interest apply to for every label put tool and to additional financing numbers, label lengths and you may attention frequencies. Particular costs don’t be eligible for additional extra interest rates and you may aren’t for sale in conjunction which have any other extra otherwise unique interest provide. For Advance Find Label Dumps, which pertains to money terms of step three, 4, 6, 9, eleven and you will one year, in addition to all of the name lengths of greater than one year. To have Label Deposits, that it pertains to investment terms of 3, six, 9 and you can 1 year in addition to the label lengths out of higher than one year.

Our very own Earliest-Give Experience Beginning a good Zynlo Lender Large-Produce Family savings

Instructors are able to use such riddles to engage college students, offer vital thought, to make learning about currency more enjoyable and you can entertaining. Delight in some extra enjoyable with our simple currency riddles that will be good for all age groups! Such simple puzzles are an easy way to pass the amount of time and you may understand anything or a couple of in the money in the act. Ready yourself to chuckle with your entertaining currency riddles that can leave you in the suits away from wit.

Projected uninsured deposits increased $63 billion on the quarter, symbolizing the first stated increase while the fourth one-fourth 2021. The online interest margin to own community banking institutions in addition to rejected in the earliest quarter and you can remains lower than their pre-pandemic average. The new banking world continued showing strength in the 1st one-fourth. Net income rebounded in the low-continual costs you to impacted income last one-fourth, asset quality metrics stayed fundamentally advantageous, and the world’s exchangeability is actually secure. However, a’s online focus margin declined because the competition went on in order to tension costs paid back for the places and you can advantage production refused.

Although not, in the event the there are more than four beneficiaries, the new FDIC exposure restrict to the faith account remains $step 1.twenty five million. Beneath the the brand new laws and regulations, faith dumps are in fact limited to $1.twenty-five million inside the FDIC coverage for each faith holder per covered depository institution. FDIC insurance policies essentially discusses $250,one hundred thousand for every depositor, for each bank, inside for each account ownership group. You might agenda LEP (Setting 1040), Ask for Change in Code Liking, to state a desires for notices, characters, and other created correspondence regarding the Irs within the an option code. You might not instantly found created communications in the expected code.